State And Local Income Tax Refund Worksheet 2019

525 to figure if any of your refund is taxable. Tax Refund Some of the worksheets for this concept are Form 75 nm fuels tax refund work nontaxable miles State and local refund work 2019 kentucky individual income tax forms Personal income tax work 2019 Application for fuel tax refund for use of power take off 2018 instruction 1040 2019 instruction 1040 140ptc property tax refund credit claim 2019.

W3 Form Explanation 3 Unbelievable Facts About W3 Form Explanation Reference Letter For Student Unbelievable Facts Printable Job Applications

If her itemized deductions totaled 17000 in 2018 the maximum taxable amount of any state tax refund received in 2019 is 5000 17000 12000.

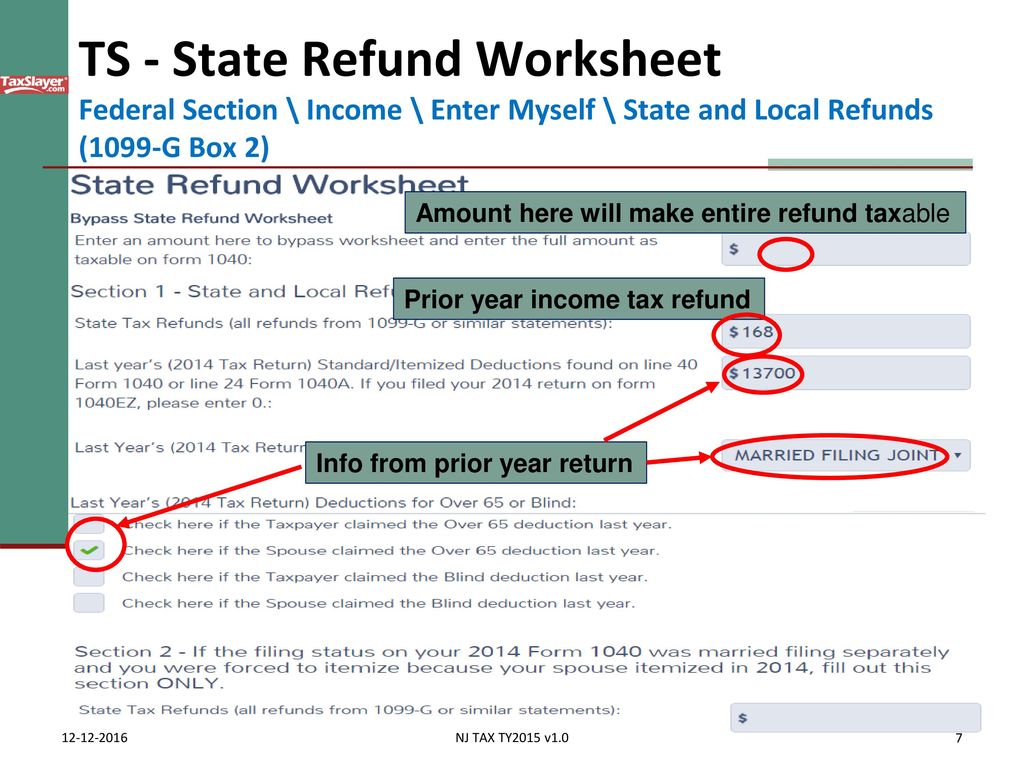

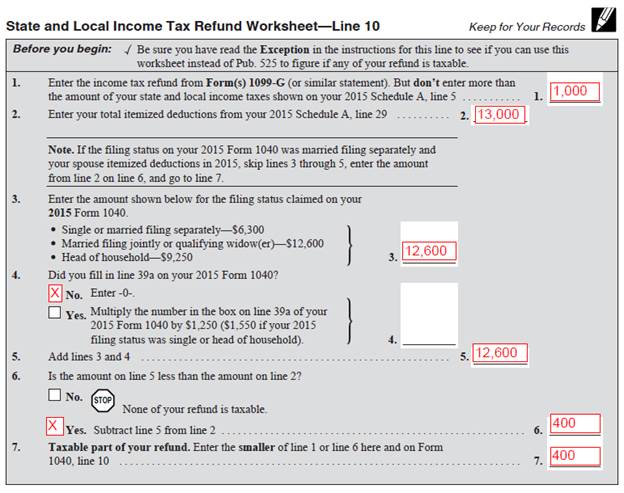

State and local income tax refund worksheet 2019. Because of the limit however the taxpayers SALT deduction is only 10000. Use a copy of the taxpayers previous year return to enter all amounts in the spaces provided. The amount of the state or local refund that needs to be included in your income is the smaller of these two amounts.

TURBO TAX ERROR on 2019 1040 State and Local Income Tax Refund Worksheet Part III Recovery Exclusion. 1017 Taxable state income tax refund Sch 1 line 1 TSO. VA refunded up to 110 per taxpayer so 220 for MFJ in October 2019 which will NOT carry forward from the prior year software.

From what Ive seen so far the 1099-Gs showing the state income tax refunds DO include the 110220 refund and will NOT match what carries forward in ProSeries or any other software so not a slam on PS Rick in VA. For the 2019 IRS Form 1040 tax return it is likely that the instructions for the line Taxable refunds credits or offsets of state and local income taxes will contain a simple worksheet for implementing this general rule. In December 2018 a small fire caused by her old homes faulty wiring resulted in 8000 damage to her home.

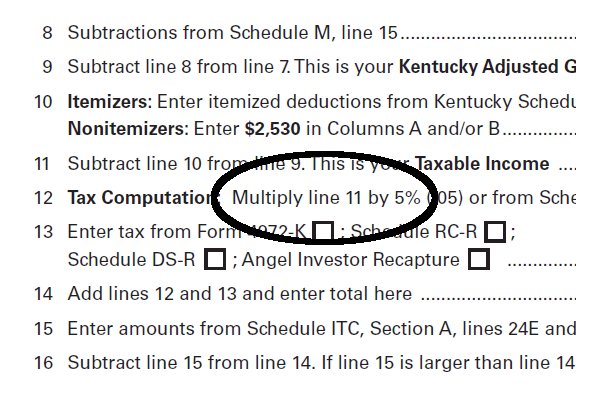

When I recalculate previous years itemized deduction by reducing the state tax payment by the refund amount - increase in tax liability is not same as amount taxable on state tax recover worksheet by proseries in current year. Look for a worksheet named Wks CY Refunds 20XX State and Local Income Tax Refund Worksheet and review it for information on whether or not there will be a taxable event. Anne Arundel Countys tax rate increased from 25 in 2019 to 281 in 2020.

Calculate and view the return. Enter the income tax refund from Form s 1099G or similar statement. TS Income State and Local Refunds Bypass worksheet line Taxable PTR refund Taxable HB refund Other income Sch 1 line 8 TSO.

Include state tax withheld and state estimated payments made during 2019. However when certain exceptions exist the taxpayer may be required to treat the state or local tax refund as an Itemized Deduction Recovery in Publication 525 instead of using the worksheet. Baltimore Countys tax rate increased from 283 in 2019 to 320 in 2020.

Not sure how the number in part III line 7 b 1 A Re-figured state and local. In 2019 the taxpayer receives a 750 refund of state income taxes paid in 2018 meaning the taxpayers actual 2018 state income tax liability was 6250 7000 paid minus 750 refund. The amount of your state and local income taxes shown on your 2017 Schedule A line 5.

525 to figure if any of your refund is taxable. State and local estimated tax payments made during 2020 including any part of a prior year refund that you chose to have credited to your 2019 state or local income taxes. The entire refund is calculated as taxable.

If you did not itemize your deductions or elected to deduct the state and local sales tax rather than the state and local income tax on your 2019 return you do not need to complete the worksheet. Dorchester Countys tax rate increased from 262 to 320. Go to the 99G screen and enter information in the Additional Box 2 Information fields.

A total of 12000 in state and local taxes is listed on the return including state and local income taxes of 7000. Line 7b 1 b is Blank. In Drake15 and prior this worksheet is titled WK_REFXX XX being the last 2 digits of the year.

I should be able to enter an amount into the program to calculate the. To review the calculations andor print the State Income Tax Refund worksheet. If you itemized deductions on your federal return in the year you received the refund all or a portion of that refund may be taxable.

Washington Countys tax rate increased from 28 in 2019 to 32 in 2020. Enter the income tax refund from Forms 1099-G or similar statement. If your total itemized deductions are greater than your standard deduction AND you dont deduct Sales Taxes.

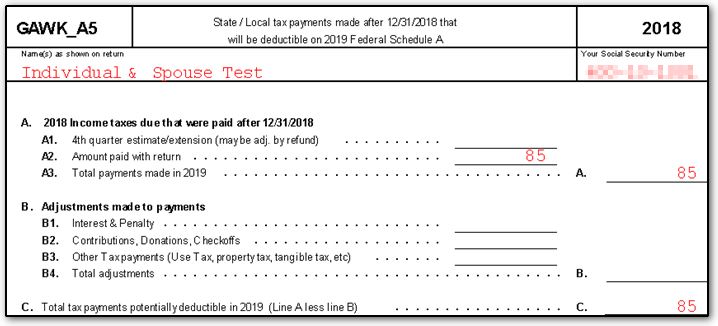

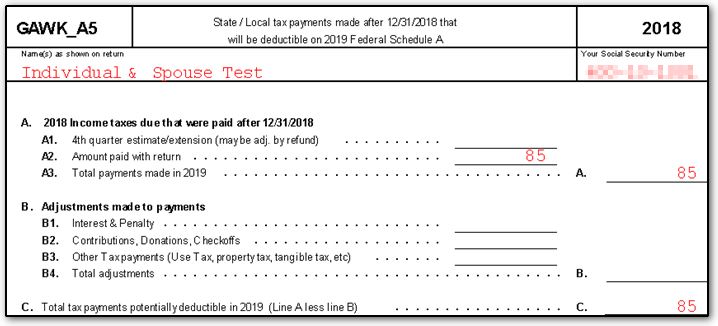

All state and citylocal taxes based on income entered on Business worksheet Taxes and Licenses section or accrued from state and citylocal returns and state income franchise taxes entered on Federal Income and Deduction category Rental and Royalty worksheet Expenses section carry as an addition to federal taxable income. The State Refund Worksheet reflects the calculation of the amount if any of the state income tax refund received that would be taxable and transferred to Line 1 of IRS Schedule 1 Form 1040. Use this worksheet to determine the portion of the taxpayers prior year state refund that is considered taxable in the current year.

Worksheet instead of Pub. Also review the State and Local Income Tax Refund Worksheet found in the Instructions to Schedule A to determine the taxable portion of the refund. State and Local Income Tax Refund WorksheetSchedule 1 Line 10 Be sure you have read the Exception in the instructions for this line to see if you can use this worksheet instead of Pub.

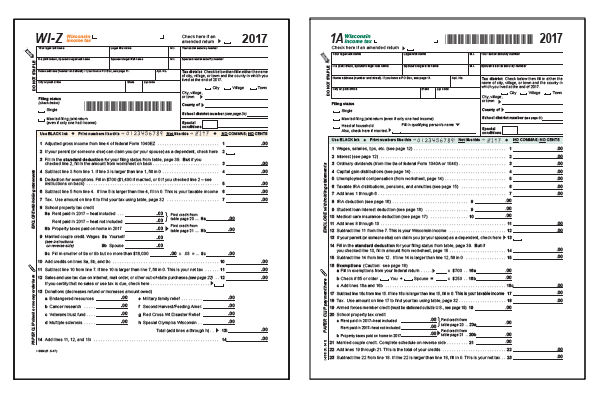

Local Tax Income Tax Rate Change. If the taxpayer itemized in the prior year. But do not enter more than.

The taxable portion will be included on the return as taxable income. Allie had 5000 in state income taxes withheld in 2018 and her state tax liability was only 3200. When calculating the TAXABLE amount of the state income tax refund on the State and Local Income Tax Refund Worksheet - Part III Recovery Exclusion.

Solved State Refund Worksheet Why The Number Is Different Intuit Accountants Community

How Do I Know If My State Income Tax Refund Is Taxable

1040 State Taxes On Wks Carry Schedulea

Income Tax Pro Incometaxpro Twitter

1040 State Taxes On Wks Carry Schedulea

Form W 2 Explained William Mary

Odr 1099 G Question And Answers Oregon Association Of Tax Consultants

Pin By Lance Burton On Unlock Payroll Template Money Template Money Worksheets

How Do I Know If My State Income Tax Refund Is Taxable

Income Tax Pro Incometaxpro Twitter

Income Tax Pro Incometaxpro Twitter

How Do I Know If My State Income Tax Refund Is Taxable

W3 Form Box 3 The Reason Why Everyone Love W3 Form Box 3 In 2021 Irs Forms Power Of Attorney Form W2 Forms

/ScreenShot2021-02-12at3.32.18PM-40b79df9059346d4aaef488825e16a46.png)

Schedule A Form 1040 Or 1040 Sr Itemized Deductions Definition

Https Apps Irs Gov App Vita Content Globalmedia State And Local Refund Worksheet 4012 Pdf